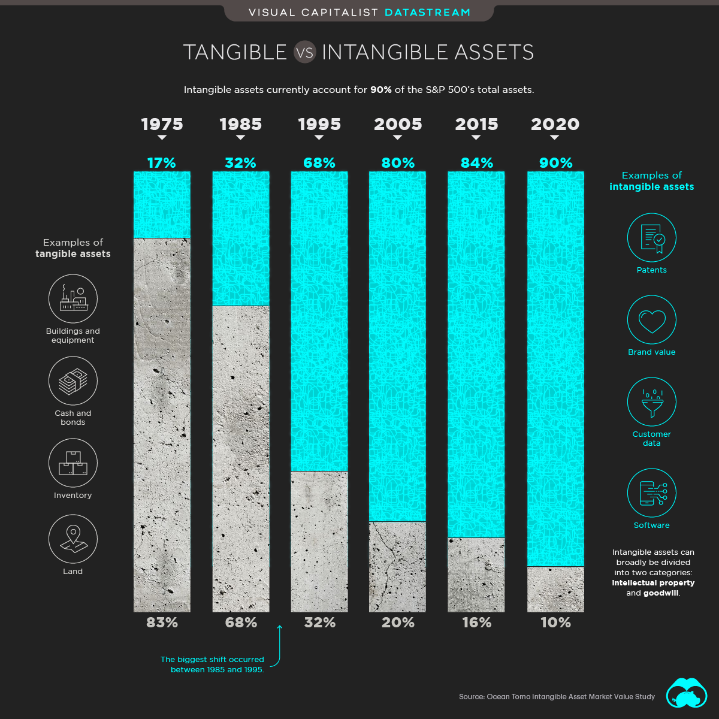

With AI and the digital revolution reaching the last miles across the globe. A pro-IP rights era is dawning upon the world that is bound to trigger financial innovation and new ways of how we look at business investments. In 2020, data by the Ocean Tomo IP firm illustrated that intangible assets attributed 90 percent of the market value for the S&P 500 Index in 2020, rising to over $ 21 trillion.

Source: Visual Capitalist– Ocean Tomo Intangible Asset Market Value Study

As an investor or a business founder, you may have thought about trading your initial shares of stock by exchanging or by market valuing your intellectual properties (IP) such as a patent, industrial design, or brandmark for paying up for shares. While trading IP for shares is possible, there remain fine print considerations that are discussed below.

READ MORE: Licensing or Franchising : Which one is right for you?

-

Time Sensitivity for IP Valuation

While it is advisable to timely have your IP right evaluated. Paying for stocks with IP demands a fair market assessment of your IPs at the time of transfer. If you purchase shares of stock at a very low “par value” price, but at the market those IPs are determined to be of a much higher value than nominal value at the time. This will ultimately show up in the audits, leading to reduced long-term market value as the company won’t be able to cover the purchase price of the stock. Whereas, if it is too high, it will lead to a negative impact on the early-stage investors, leading the company to lose growth and future leverage potential. Our experts at Nicomedia Legal Associates recommend considering periodic evaluations of the appropriate useful life attributable to stock offer price involving registered IPs. This assessment can help you determine the accurate price and spending capacity of the investors to gain a better share of the market investments.

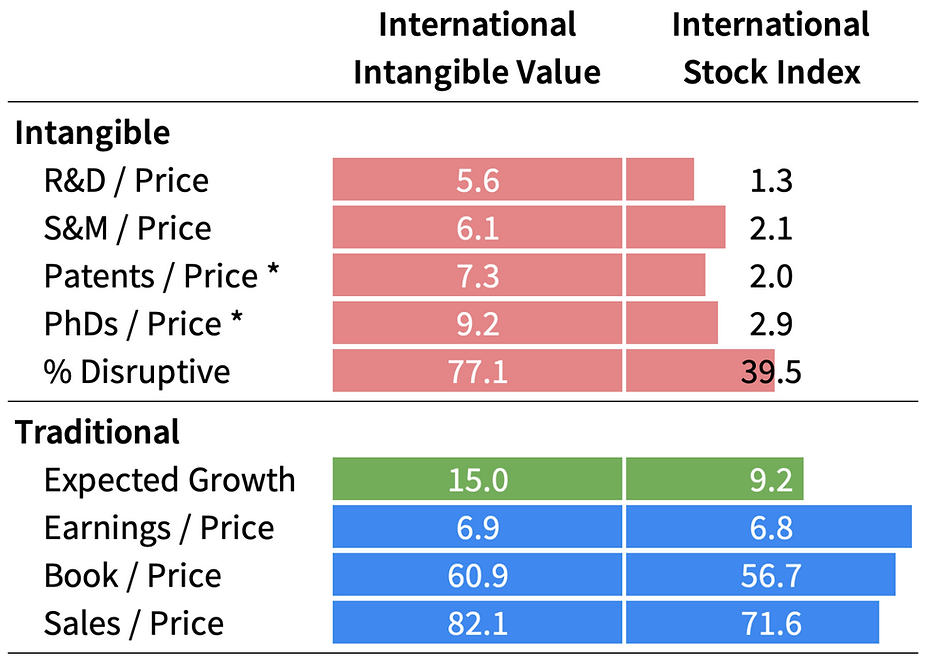

Expected Growth Rate on Intangible Trade-ins

Source: Sparkline Capital study on International Intangible Value. Employed International stock index is MSCI ACWI ex-USA. All ratios are in percentages, except those with asterisks, which are scaled by billions (e.g., # patents per $1 billion market cap). Disruptive Percentage are firms engaged in technologies , Healthcare and BFSI Industry. All calculations are weighted averages with weights equal to position size. Date updated as of 31st December, 2023.

READ MORE: Legal Best Practices for VFX Creators and Service Providers.

-

Tax-Exchange Implications:

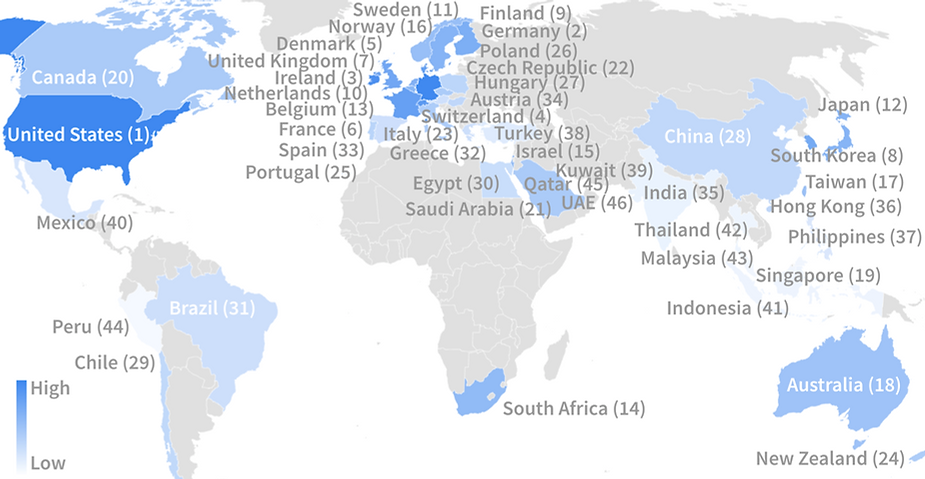

Exchange of IP assets for stocks is a taxable undertaking, and value investors favour companies that are cheap compared with a potential for higher expected earnings. While founders need to create a competitive ability to scale up against market incumbents. The good news is that in India, the legal system has held the principle of ‘Mobilia Sequuntur Personam’ for intangible assets (also considered movable assets) in such scenarios. Whereby the location of the IP owner determines the tax applicability since intangible assets are considered movable assets and Section 9 of the Indian Income Tax Act, 1961, observes domestic capital gains only. Therefore, tax on intangible assets exchanged for stocks only applies to domestic investors but not to international investors. This is a viable means if you are a founder raising capital for your start-up or, as an investor, you seek to invest in upcoming markets like India.

Additionally, Germany and UK tax law do not provide a tax-neutral step-up of the value of tangible or intangible assets in a share deal. Relevant legal consultations are required to go ahead on the said investment. Whereas in the US, exchanging IP for stock is reviewed under the country’s Section 351 of the Internal Revenue Code. Nicomedia has global legal partners based on your geographical requirements; book a consultation to find out more.

Source: Sparkline Capital Study on Intangible value scores averaged at the country level Data as of 31st December, 2023 .

READ MORE: How to stop your customers from buying counterfeits?

Conclusion :

A company’s value lies in offering its investors the ability to cause greater market disruption at reasonable prices. Hence, to capitalise stock intellectual property is a great way to offer innovation, reducing near-term volatility and market dominance. Therefore, if you are considering exchanging intangible assets for stock, make sure that you:

- Consult a legal professional to consider documented compliances and their implications before you buy stock with IP;

- Ensure that the IP assets are properly described, registered, and assigned with due diligence for future tax consequences.

- Nicomedia recommends paying the par value of the stock in cash; this ensures that your stock is fully paid for.